Actuarial Intelligence Dashboard

The actuarial dashboard empowers insurance companies to offer customised and innovative products at competitive prices.

We know insurance companies need rapid access to data in order to create customer-centric insurance solutions.

Crosure’s Actuarial Intelligence Dashboard builds highly accurate actuarial models in a short amount of time, giving insurance companies the ability to make data-driven decisions with increased speed, utilising flexible and transparent AI-generated data.

The cutting-edge Actuarial Intelligence Dashboard from Crosure gives insurance companies the power to tap into niche and microinsurance markets, by designing tailor-made products with the assistance of our exclusive, one-of-a-kind proprietary algorithms.

The Crosure Actuarial Intelligence Dashboard drives innovation with its advanced insurance analytics and essential business intelligence insights.

Get better, faster, more accurate critical intelligence insights using the power of machine learning and advanced insurance analytics

The Crosure Actuarial Intelligence Dashboard (AID)

- Provides critical intelligence insights to senior management and actuaries based on the proprietary “peer factor” (patentable) model.

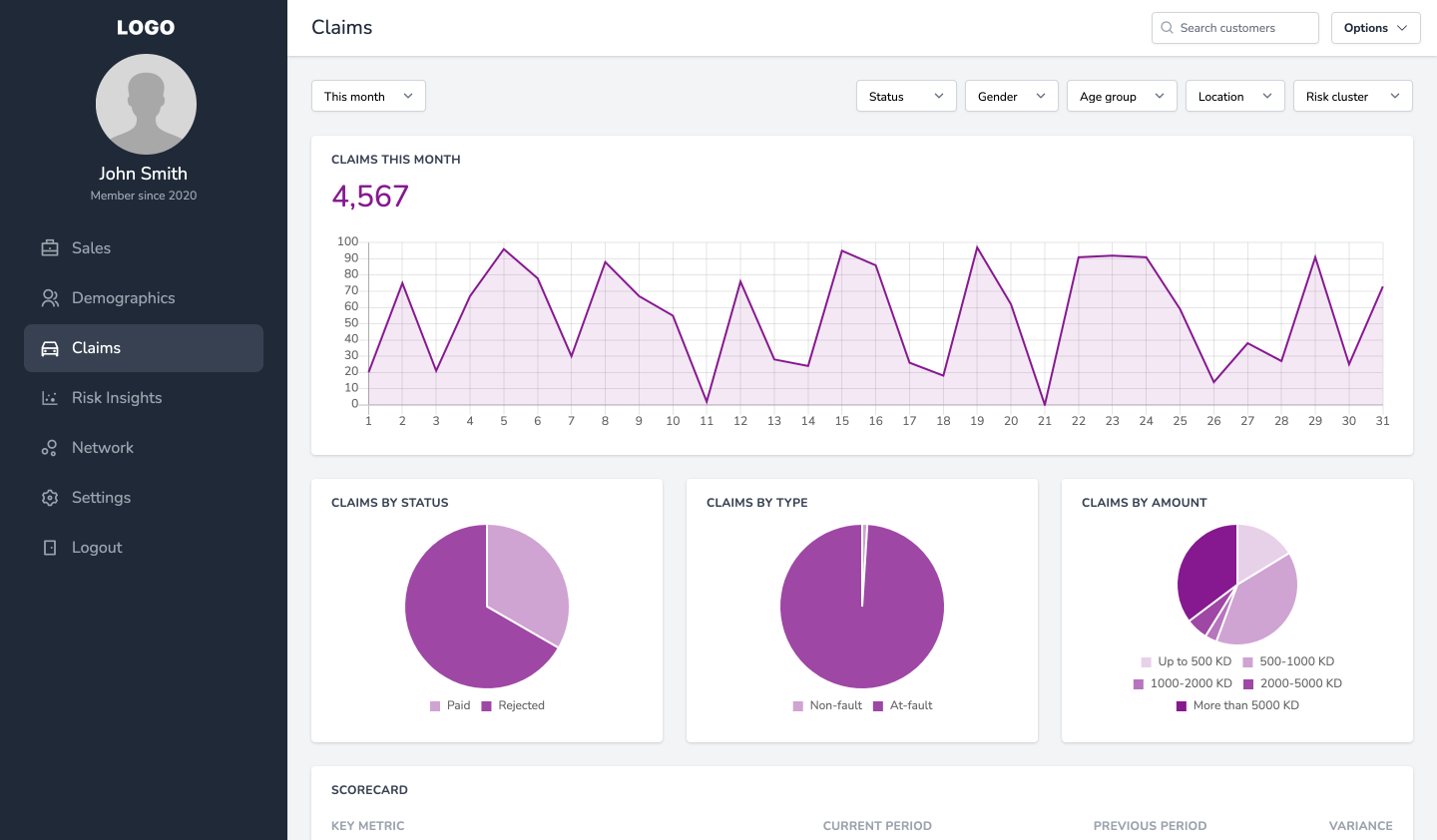

- Supports standard aggregated reports of critical parameters and KPIs, and can be segmented and searched based on various customer attributes.

- Exploits telco data to form pools of policyholders based on traditional risk attributes, as well as social peers such as friends, family, and community. Helps visualise similarities by vectorising attributes and providing a similarity score.

- Enables you to generate and share instant reports on insurance indicators such as claims paid, value claims paid, gross loss ratio, net loss ratio, claims rejected, rejection ratio and more.

- Performs advanced risk analysis and actuarial data modelling using variables such as telco data and propriety Crosure algorithms that provide intelligence on the profiles of “ideal target customers” prior to sales generation.

The cutting-edge Actuarial Intelligence Dashboard from Crosure gives insurance companies the power to tap into niche and microinsurance markets, by designing tailor-made products with the assistance of our exclusive, one-of-a-kind proprietary algorithms

Work with us for a win-win digital insurance solution

Unlike many providers, we don’t just create your platform and leave you to it. We’re here for the long haul. We help you implement the technology and maximise its potential.

In fact, other than a minimal calibration fee, our payment is results-oriented. We get paid when you’re successful.

Contact

Set up a call to talk through the specific requirements of your business. You’ll choose the modules you need from our product suite and we’ll create a bespoke plan for customisation and implementation.

Customisation

Depending on the scope of the project, we’ll need 1-2 months to calibrate your platform. We have the resources to ensure it starts generating value for your business in the shortest possible time frame.

Collaboration

Upon completion of the implementation, we’ll continue collaborating with your internal team to deliver optimal outcomes. We offer a range of customisable support packages so you can be confident we always have your back.

The Crosure Actuarial Intelligence Dashboard drives innovation with its advanced insurance analytics and essential business intelligence insights

CanadaHQ

Company Number:

1232649-3

Registered office:

1 Rideau St.

Suite 700

Ottawa

Ontario K1N 8S7

United Kingdom

Company Number:

11076711

Registered office:

Nine Hills Road

Cambridge

England

CB2 1GE